Connecting external brokers with internal Ops team to handle critical data

PrimaryBid give everyone fair access to IPOs and public company fundraises, at the same time and price as institutional investors.

Public markets were created to allow everyone to invest in and own companies they believe in. But the public has been missing out on valuable share offers for decades. Until recently, only institutional investors could access IPOs and follow-ons. PrimaryBid is changing that. They’ve created the technology to make sure public markets are inclusive, transparent and fair, as they were always meant to be.

Industry

Fintech

Client

PrimaryBid

Service

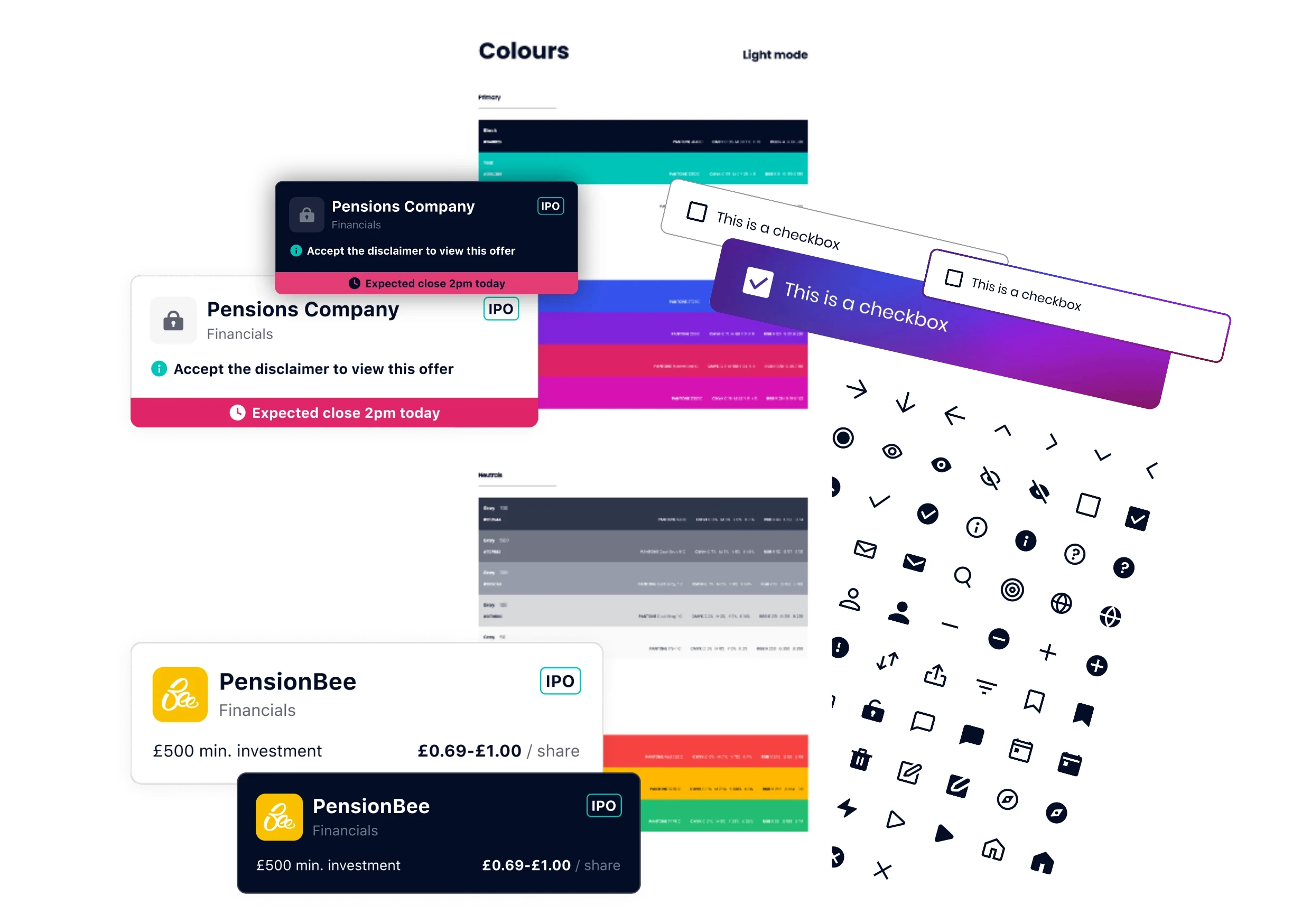

Product Design

Date

January 2023

Challenge

International expansion, marketing and commercial teams do not have enough product capabilities to start deepening relationships with partners. This limits PrimaryBid’s ability to gauge demand and estimate deal pipeline in international market ahead of launch. Manual order submission is a high risk, laborious manual approach which is prone to human error. Brokers submit orders shortly before the deal close, this results in actions being carried out with urgency and may resulting in errors.

Goal

Improve internal team productivity by eliminating manual work worth 120 hours, eliminate human errors and increase partner productivity.

Solution

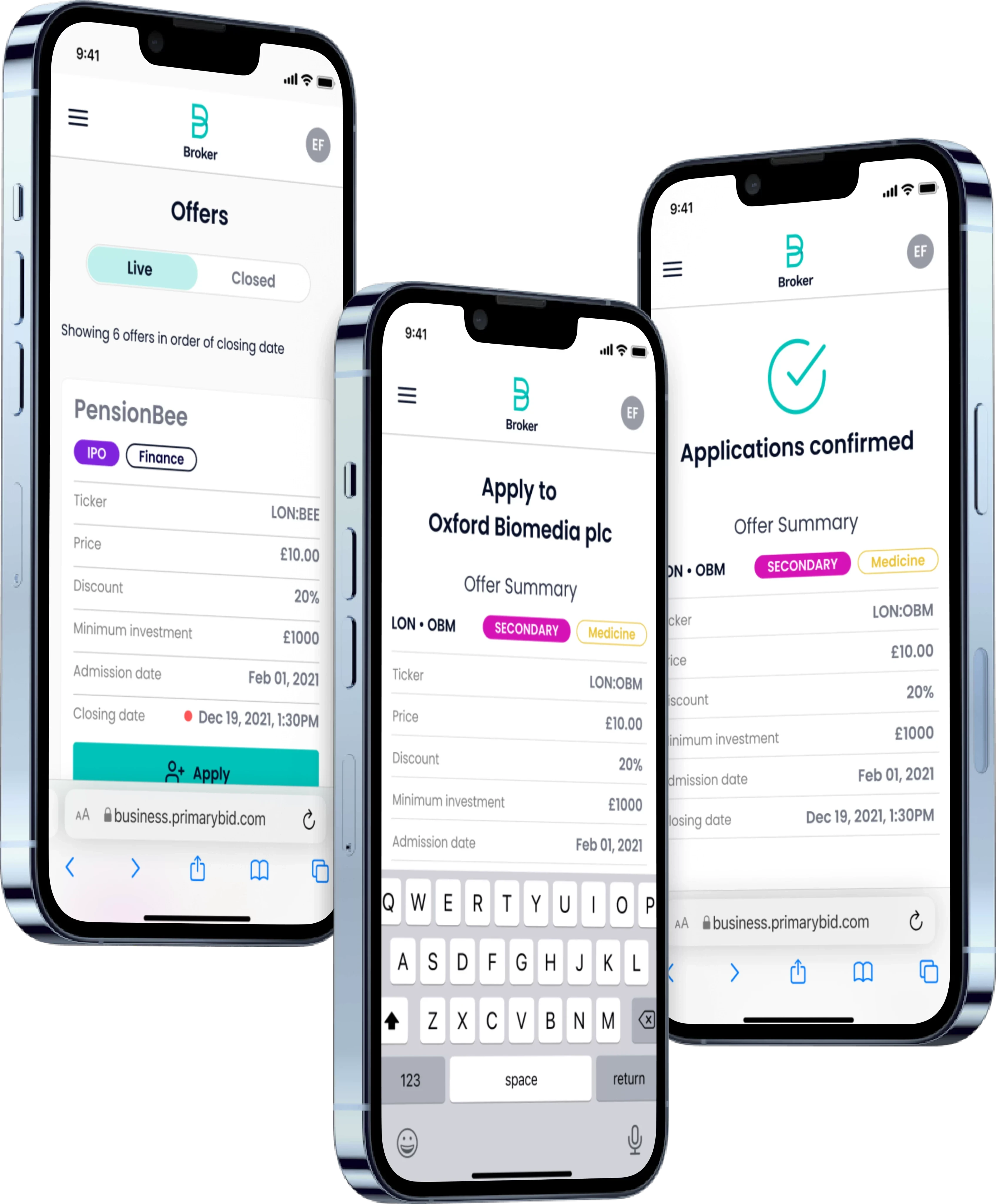

PrimaryBid Connect is a platform that sits in between the PrimaryBid Ops team and the various partners, helping streamline the process and addressing all the previously mentioned issues, allowing the broker to apply for a deal directly on the PrimaryBid side without having to manually move data from one tool to another.

The impact of this solution 3 months after the launch:

49 transactions,

£2.3M transacted

62 broker onboarded

To read more in-depth, please check my Design stories article